“It’s what you sow that multiplies, not what you keep in the barn.” Adrian Rogers

Donating monetarily to Zion and/or any charitable organization is great. But did you know, there may be ways to significantly increase your impact by donating appreciated assets such as stocks, mutual funds, and bonds? There are a few benefits of donating the asset directly instead of first selling and converting to dollars. First, you can potentially avoid the capital gains tax you would incur if the asset was sold before donating the proceeds. Second, you may claim a fair market value charitable deduction for the tax year the gift was made.

Please note: I am not a tax expert nor financial advisor, so if you have any questions or would like to seek additional information, I would recommend speaking to your trusted advisors.

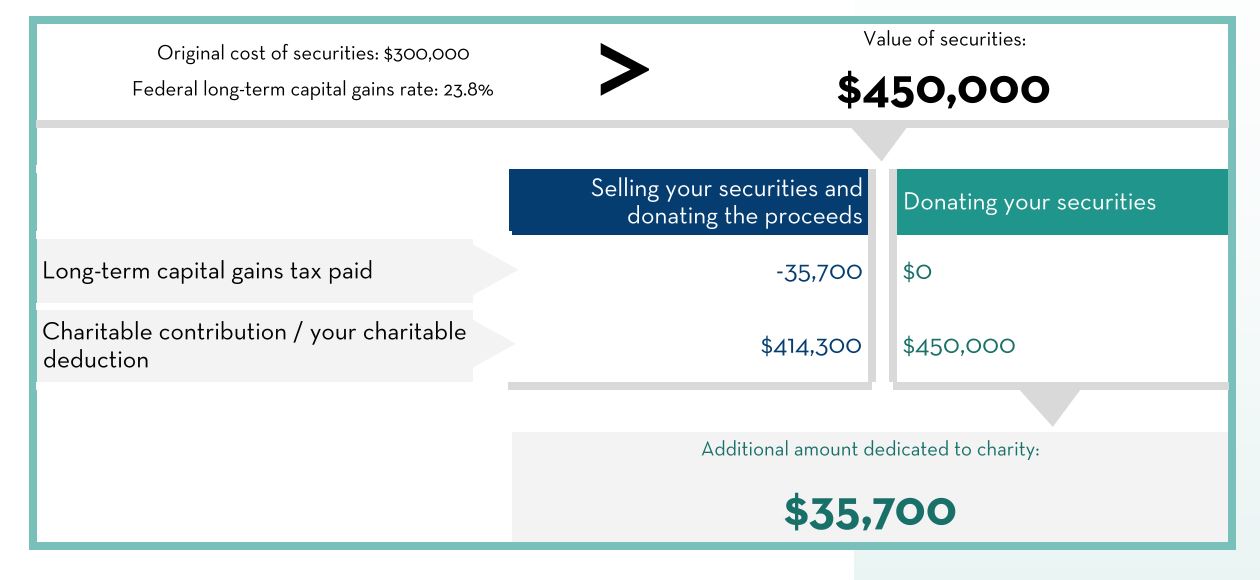

I found this example at Fidelity Charitable, a division of Fidelity Investments:

The example above showed two ways an asset of $450,000 could be given to charity. By first selling the asset, the owner was subject to long-term capital gains tax and could potentially reduce the gift by $35,700, about 8% less than if the asset was gifted directly. According to their website, there are some specific limits; up to 20% to 30% of your adjusted gross income can be gifted this way depending on if it is gifted directly or gifted through a donor-advised fund such as Fidelity Charitable, Schwab Charitable, etc..

For anyone that has to take minimum required distributions from their retirement accounts (age 72+), I would highly suggest they look into this more as an opportunity to increase the impact of their charitable giving and potentially reduce their tax liabilities.

If you would like to transfer stock or other assets to Zion as part of your charitable giving in 2023, please contact Steve Peterson in the office at 763-682-1245 extension 111 or by email at steve@zionbuffalo.org.

Links to useful information (but please consult your trusted advisors to see if this is right for you):